Tariffs have been the main word on everyone’s lips as the US introduced a series of tariffs on all its trading partners, including the UK, Europe, Canada and China that initially negatively impacted global equity and fixed income markets. These losses were almost instantly met with powerful rallies, as tariffs were paused and on the hopes of achieving trade deals. This turn of events was thought of positively by both equity and fixed income investors globally.

As we enter the second half of 2025, the main indices in the UK, Europe and the US are all starting having posted positive returns of 7.2%, 8.3% and 6.2% respectively. A remarkable turn of events especially considering they had fallen by approximately 12% during the first week of April and at that stage were nursing year-to-date losses. Markets have clearly shown resilience, once again and faced with this year’s numerous challenges, as they did when we faced the Covid pandemic, and as they did when faced with the Global Financial Crisis of 2007, to name but two of many challenging periods!!

Going forward, we still do not know what the impact of tariffs will be until deals between the trading partners have been concluded. Equity markets need that clarity too and will likely find it difficult to surge further ahead without that certainty. We anticipate that equity markets could tread water over the short term, only reacting positively once trade negotiations have concluded.

Away from tariffs, recession risks are low, but inflation remains sticky. If there is a further economic slowdown, interest rate cuts are likely. This would be supportive of equities and we would expect, in this scenario, not to encounter higher volatility ahead. Whilst we remain optimistic that the longer-term outlook remains promising, shorter-term multi-asset and geographical diversification remains key to thriving in markets that may continue to be defined by volatility and unpredictability.

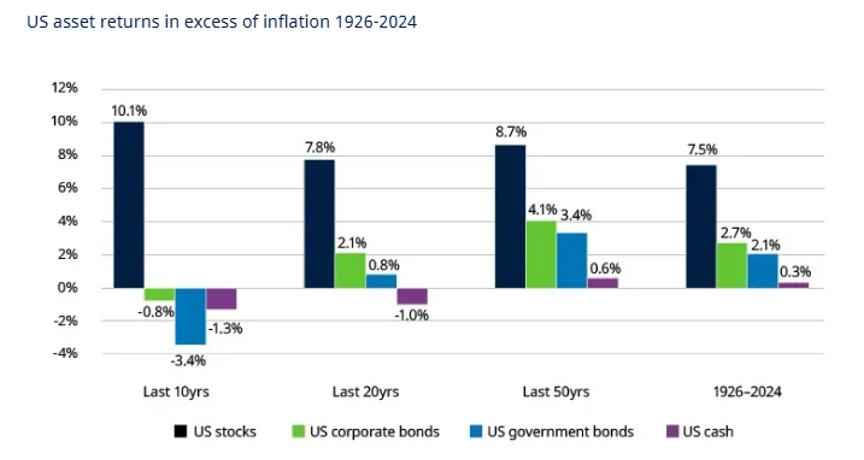

During such times, I am reminded that there is always something to worry about but, if like us you remain longer term focused, the past will likely repeat itself in so far that historically equity performance has beaten fixed income performance which have both beaten the performance of cash. Schroders have produced a chart that perfectly captures this performance using US assets over the period 1926 to 2024.

Source: Schroders, accessed 2nd July 2025.

0 Comments