Market Update from Michael Zacharia, May 2025.

Despite the almost 20 weeks (to date) of 2025 being a ridiculously small timeframe for the long-term investors, it will adorn financial dinner table debates for many a year to come.

US equity markets were initially rocked by falling share prices in US large companies and particularly within the technology sector following China’s DeepSeek claiming it had developed an Artificial Interface model at a fraction of the cost of US equivalents. Elsewhere UK, European and Emerging Equity markets all benefitted as global allocators started to reallocate away from US equities.

Then we had April’s Liberation Day announcement from Donald Trump which imposed a minimum 10% tariff on global markets and consequently sent all major equity markets tumbling over fears over a global trade war. US, UK and European benchmark indices fell between 10% and 15% before instantly rallying following a temporary suspension of the tariffs to end the month of April where they had started. In fact, if you fell asleep at the start of April and woke at its end it would be understandable if your view was that nothing happened, but April can best described as a wild month and an unexpected Trump-made crisis month that nobody foresaw coming.

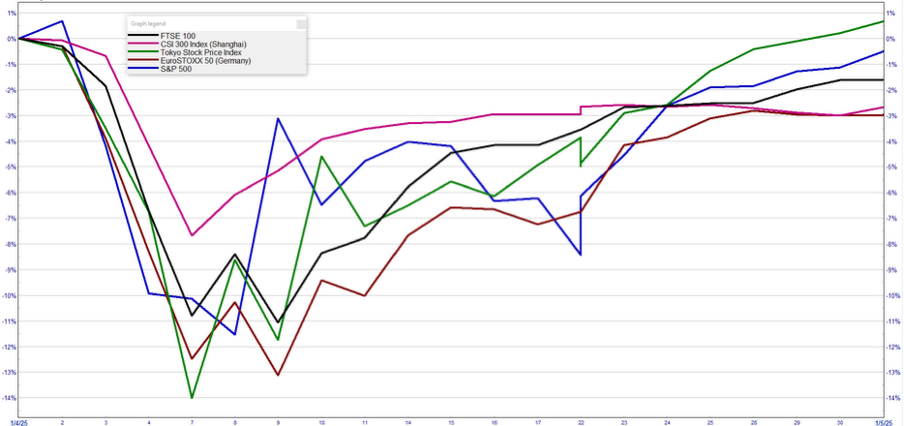

Here is how the UK, Europe, US, China and Japanese equity markets fared during April’s equity market malaise …

The chart above has been produced from Sharescope and shows The FTSE 100, EuroSTOXX 50, S&P 500, CSI 300 Index and Tokyo Stock Price indices. (28.05.2025).

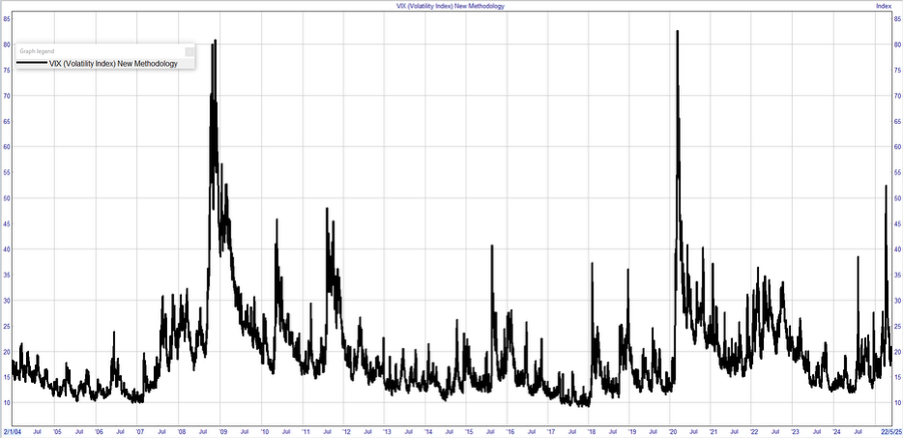

The VIX index, which is also known as a fear index spiked to levels only surpassed during the Covid days and before that during the Global Financial Crisis of 2008/09. Here is how the VIX index has performed since January 2004 …

The chart above has been produced from Sharescope and shows VIX (Volatility Index). (28.05.2025).

Such events are not common and impossible to react to over the short term. Does one sell, buy or perhaps acknowledge that 10%+ equity market falls seem to occur more years that not and continue to hold firm? Fortunately, we held firm comforted by the knowledge that we have aimed to construct diversified and long-term focused portfolios and that our underlying thesis would not be impacted. Short term, we were right to do so but there are currently more unknowns than usual (thank you tariffs) and so the extent of any economic damage they may cause remains difficult to determine, especially against a backdrop of potential tariff negotiations.

For us, we are pleased the April stress is seemingly over. Currently markets are considerably calmer and our approach, which we describe as “keeping a cool head”, remains focused on our favoured managers and allocating globally. In fact, we think it would be a huge mistake to overreact to such ‘wild’ events. Cool heads need to prevail. Our portfolios remain anchored by diversification and spreading investments across different styles, sectors, and strategies helps us to enhance our portfolios resilience.

I started by saying that 10% falls happen regularly, in fact since 2000, there has been approximately 18 such falls in the MSCI World Index but over the same period, equity markets have beaten fixed income returns which themselves have beaten cash returns. Cool heads prevailed then, and we believe there is no reason why they will not prevail again. As you can see below, even over the last 20 years and including the various crises, an investment into the FTSE World would have returned you over 100%. In fact the total return was 260% which represents an annualised return of over 13% per year.

The chart above has been produced from Sharescope and shows FTSE All-World Index. (28.05.2025).

As we look ahead, there will always be uncertainty whether due to geopolitical shocks, economic shocks or some other shock but it is important to remain focus on achieving your long-term aspirations and not to become too distracted by bumpier times which may at times push your portfolio returns closer to or outside expected volatility ranges.

Have questions? Come and talk to us about what we can do and how we are managing your portfolio through these times.

*With investing your capital is at risk. Past performance may not be indicative of future results.

0 Comments